Planning for Retirement

Planning for Retirement

It is a natural human instinct to want to be safe and secure as well as protective and caring towards the people most important to us. This entails finding a balance between what we do now, in the present and what we work towards in our futures.

Work brings many rewards and one of these is to know that we can plan towards a comfortable life after we stop work. It is important to begin to think about the provisions that can make this happen for you and to understand how a pension is a key means of helping to achieve the future you strive for.

On this page

- Why have a pension?

- What are the types of pensions I can choose from?

- Allowances

- How much money will I need to save to retire?

- What can I invest in?

Pensions Explained

We’re always being told that we need a pension, yet what is a pension? You’d be right to think it is a provision for your later years, yet did you know that it is also a very tax efficient investment? Not only does it provide you with an income when you stop working, paying into your pension is also tax efficient right now.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

The levels and bases of taxation and reliefs from taxation can change at any time. The value of any tax relief depends on individual circumstances.

Why have a pension?

Investing into a pension allows you to create and build up a financial portfolio which aims to provide you with a comfortable and enjoyable retirement. If you rely solely on state benefits for your retirement income, you may find that this is not enough to provide you with the lifestyle you are accustomed to, or would like. The key to getting it right is first of all to know what you want and what is important to you and then to start planning as early as possible.

Secondly, it may surprise you to know that there are many advantageous tax reliefs available when you invest into your pension.

Income Tax

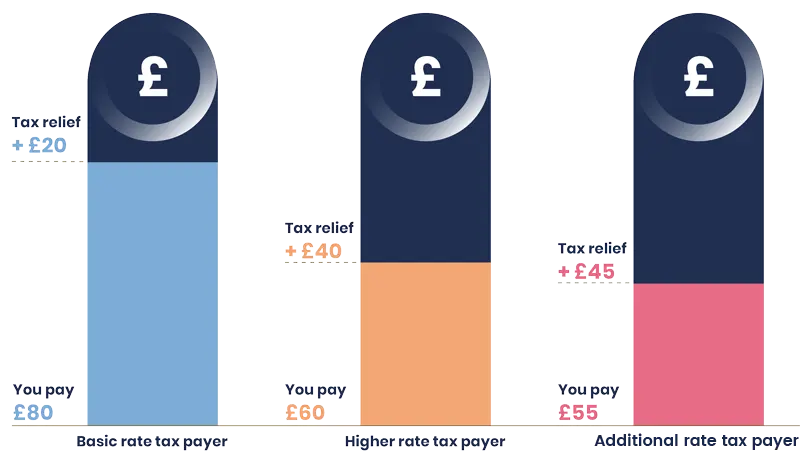

When you invest your money into a pension you can receive tax relief on the contribution that you make at your rate of income tax. This will be either at 20% for basic rate tax payers, 40% for higher rate, or 45% for additional rate tax payers. This is assuming that anything over the basic rate of income tax is reclaimed via the individual’s self-assessment tax return.

You can also pay into a pension through Salary Sacrifice. Salary sacrifice can suit some people very well, as a tax efficient way of paying into a pension. It’s not right for everyone, so it is very important to take advice on your options.

To Invest £100 in a Pension

Corporate Contributions

As a business owner you have the option of paying into a pension scheme utilising corporate profits. This option potentially saves on National Insurance Contributions, Income Tax and/or Corporation Tax. Seek advice on this if you fall into this category.

Capital Gains Tax (CGT)

Capital Gains Tax is usually charged when you have profited from an investment or asset. A capital gain can be taxed up to a maximum of 28%.

However, within a pension there is no Capital Gains Tax payable on the growth of your pension, so this is a significant benefit.

Inheritance Tax (IHT)

Usually pensions are Inheritance Tax friendly, meaning that when you pass away the funds can be handed down to your beneficiaries, with no IHT payable. Many people find this reassuring, knowing that their money can continue to support loved ones after their death.

What are the Options I can choose from?

There are lots of possibilities out there, which is great because it means that there are usually plans which will suit everyone. You will require a plan that matches both your income and your priorities. We will work closely with you to identify things that are important to you. We will help you to make the right decisions when the time comes to retire so that you can feel more confident.

Working with a carefully selected panel of providers, we offer access to the following range of products:

A SIPP is a pension wrapper which provides a range of options in which you can invest in, such as commercial property and share portfolios.

Personal Pension

A Personal Pension is a pension where you can save monies from any age until you retire. Drawdown Plan – At retirement this plan will give you the flexibility of taking your savings as an income, lump sum and/or tax-free cash of generally 25%.

Flexible Access Drawdown

At retirement, this plan will give you the flexibility of taking your savings as an income, lump sum and Tax Free Cash of generally 25%.

Annuities

An annuity is an insurance product that you can buy with some or all of your pension. It pays a guaranteed regular income either for life or for a set period, at an agreed annuity rate.

Allowances

How much can I invest into my pension?

Pension annual allowance is a detailed area which requires specialist knowledge and expert advice to enable you to make the best choices.

The maximum personal contributions that can be made into pensions in order for you to obtain tax relief is calculated by some key factors.

It is made up by the greater of your relevant UK earnings or £3,600 subject to the current Annual Allowance of £60,000: (subject to Tapering this may vary between £10,000 and £60,000 determined by your ‘adjusted income’).

What is Tapered Annual Allowance?

The annual allowance of £60,000 per annum will potentially be reduced (tapered) for high earners. Prior to 6 April 2020, if you had total adjusted income in excess of £150,000 per annum, you would have seen your annual allowance reduced by £1 for each £2 this is exceeded, to a minimum of £10,000.

With effect from 6 April 2023, tapering occurs where you have adjusted income in excess of £240,000 per annum, in which case you will see your annual allowance reduced by £1 for each £2 this is exceeded, to a minimum of £10,000.

This is a very complex area and so it is vital that appropriate advice is sought.

What is the Lifetime Allowance?

The lifetime allowance on pensions is currently £1,073,100. From 6 April 2024, HMRC have proposed to abolish the lifetime allowance from pension tax legislation.

The regular changes in the Lifetime Allowance mean that advice is more important than ever to ensure that you are optimising and monitoring your contributions.

We offer lifetime allowance calculations to check if the value of your benefits are close to or exceed the current lifetime allowance. Exceeding the lifetime allowance means that you may have to pay additional tax at 25% or 55% on amounts over the allowance. You may have options to protect your lifetime allowance by applying for ‘Protection’ offered by HMRC.

This is a technical and complicated area and requires specialist advice, please feel free to call to discuss this subject further.

What is Carry Forward?

You may be able to contribute in excess of current tax year’s Annual Allowance of £60,000, or your tapered annual allowance if applicable using Carry Forward.

This would happen if you have contributed less than the Annual Allowance in the previous three tax years and were a member of a UK registered pension scheme during that time.

As this is a potentially complex area, particularly where Defined Benefit schemes are concerned, advice should be sought.

The levels and bases of taxation and reliefs from taxation can change at any time. The value of any tax relief depends on individual circumstances.

How much money will I need to save to retire?

So it’s all very well knowing what you are able to invest, the next question is to create your vision of what outcome you would like to work towards. What kind of income are you looking to achieve in retirement?

This means considering what is important to you in your life and how you envisage spending your time. The sooner you consider these questions, the sooner you can choose when to start creating your pension plan. Generally speaking, the earlier you can start saving into a pension the better off you could be.

We can support you throughout this process to explore key considerations and to develop your bespoke vision, and set the appropriate financial goals. We can then help you to statistically map your finances to provide you with an overview of your existing situation and a clear vision of how to reach those goals.

What can I invest in?

Finally, you might want to consider what you would like to invest in. Again, you have a number of considerations to match your wants and your values. As a Partner Practice of St. James’s Place we have access to a range of portfolios or bespoke funds which can be tailored to you and your appetite for risk.

St. James’s Place Investment Management Approach aims to select the best fund managers from across the globe. They then monitor the performance of your funds on an ongoing basis and make changes and adjustments where necessary.

We take Responsible and Sustainable Investment very seriously and endeavour to embed a responsible approach across the entire way we conduct our business. We fully support the ever-growing integrated approach of St. James’s Place to responsible investing as we believe this means we can cater to all of our clients needs.

St. James’s Place offer a bespoke Responsible and Sustainable Fund which aims to benefit from any potential opportunities arising from this shift to a more sustainable world, such as the clean energy transition, advancement in healthcare technology and the mitigation of climate change.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

Get in touch today to discuss your pension